Consumers are Purchasing More Plant-Based Foods – Why it Matters and What it Means for Your Operation

We’ve all heard about the growing popularity of plant-based foods, but is this a product category that is here to stay? Should you be looking to add plant-based alternatives to your menu? While it’s always difficult to predict what the future holds, there are some early indicators that suggest growth in plant-based proteins is a real trend, not a fad. Here’s what you need to know:

Consumers are willing to pay more for meat alternatives because the products are perceived to be healthier and more sustainable.

Customers are changing their purchasing habits from less red meat to more plant proteins. Because plant-based foods are seen as healthier, 74% of consumers believe it’s worth the premium cost.1

It’s no secret consumers are becoming more interested in how their diet affects their health. Eating more plant-based proteins has been linked to reducing the risks of cancer, heart disease and other medical conditions. Customers are also buying into plant-based diets to help mitigate obesity with cleaner eating, increased energy and younger looking skin.

According to multiple studies, a plant-based diet has been shown to lower high cholesterol and blood pressure and reduce the risk of cardiovascular disease and chronic heart disease. Based on the findings of 95 different studies related to cardiovascular disease, researchers concluded that a person’s risk is greatly reduced by eating more fruits and vegetables on a daily basis.2

Consumers also have a desire to purchase products that are less harmful to the environment. In fact, 81% of millennials are willing to pay more for a product if it comes from a sustainable brand and 37% of people are buying meatless alternatives because they are better for the environment.3 Production of plant-based foods also positively impacts climate change and 75% of crop “energy” converts to plant protein.4

According to Mintel’s plant-based proteins report from 2018, 64 million people are seeking more plant-based proteins. An overwhelming 79% of millennials are eating meat alternatives, while 20 million people identify as vegan or vegetarian. What’s more is 31% of consumers believe meat is no longer essential to the human diet and 23% of current meat eaters would like to follow a less-meat oriented diet, a study conducted by Dataessential Plant and Cellular Foodscape found.

Flexitarians, a rapidly growing consumer segment, are driving the popularity of these plant-based foods. This group has very specific and unique needs.

Vegetarians and vegans continue to be an important and growing segment, but there’s another developing category of consumers to keep in mind. Flexitarians, in contrast to vegetarians and vegans, eat meat or fish, but they actively seek to reduce their intake. For perspective, 32 million people identify as flexitarian and 95% of consumers who have ordered a plant-based burger in the past year also ordered animal-meat burgers.5

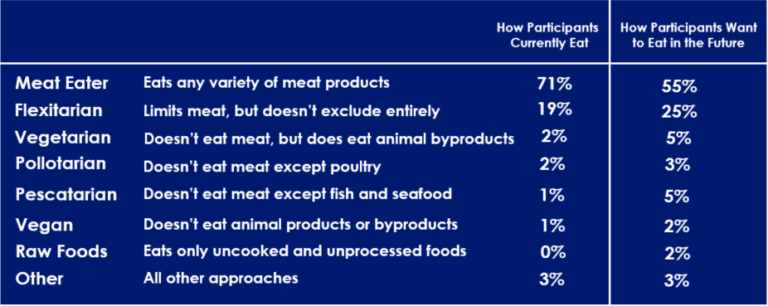

In another study conducted by Dataessential Plant and Cellular Foodscape in 2017, participants were asked to consider their current eating habits and then to consider how they wish to eat in the future. The amount of meat eaters decreased 16% when asked how they would like to change their eating habits, while those who would like to become flexitarian increased 6%.

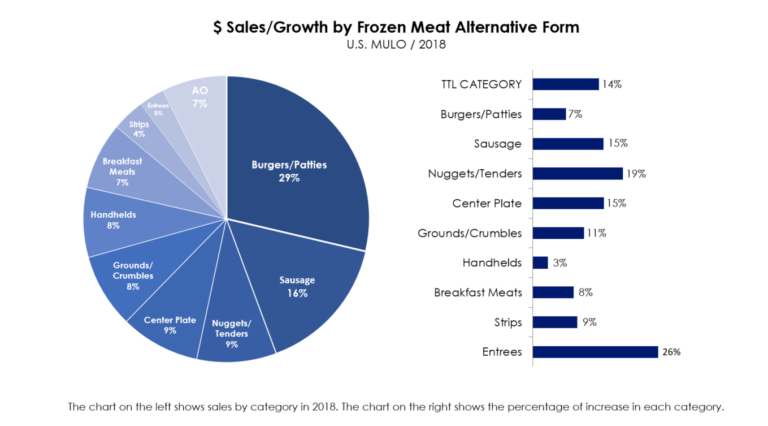

Consumers are looking for diverse options. While veggie burgers continue to be popular among vegetarians and vegans, flexitarians are looking for products that go beyond. Based on findings from U.S. Mulo in 2018, frozen meat alternative entrees saw the highest category increase in sales at 26%. Plant-based nuggets and tenders jumped 19%, while frozen meatless sausage and center plate items increased 15%. Millennial families are believed to be driving this shift because they are seeking items that are not only quick and easy to prepare, but also options that their children will eat.

For Flexitarians, taste is a critical driver for purchase behavior and as manufacturers continue to improve formulations to better mimic meat, expect more consumers to jump onboard. Currently, 60% of those who aren’t interested in plant-based foods cite taste as the main reason.6

Why Sustainability in Foodservice?

Restaurants that offer meatless proteins have not only seen sales increase, but have also welcomed a significant number of new customers.

Markets have already seen a significant impact. More than 31% of restaurants have added plant-based foods to their menus with that number expected to grow to 35.8% by 2023. From a financial perspective, sales increased 15% in 2017 and 17% in 2018. Sales are projected to be even higher in 2019.7

Still don’t believe it? A major chain restaurant that incorporated a plant-based item to their menu saw a staggering 36% increase in sales during the first month in the test market and 20% of the customers were new.8

The increase across the market is so large that plant-based proteins are no longer just a meat replacement – they are becoming a category of their own.

Sources:

1Mintel, Protein Alternatives Report, 2017

2Bechthold A, et al. Food groups and risk of coronary heart disease, stroke and heart failure: A systematic review and dose-response meta-analysis of prospective studies. Critical Reviews in Food Science and Nutrition. In press. Accessed Feb. 27, 2019.

3Dataessential Plant and Cellular Foodscape 2017

4Beyond Meat Fever Turns the Tiny Pea Into America’s Hot New Crop, Bloomberg 2019

5Mintel, Plant Based Proteins Report, 2018

6Impossible Foods June 2019 Brand Tracker

7IRI, Ttl MULO, data CY 2014-2018; Total Meat Alternatives = Frozen + Refrigerated

8Burger King Bets on Impossible, Earnest Research 2019